MyFedLoan is an essential tool for federal student loan borrowers, providing secure account access for managing loans, making payments, and exploring repayment options. This guide simplifies the MyFedLoan login process while answering key questions borrowers often have.

What is MyFedLoan?

MyFedLoan is a platform operated by the Pennsylvania Higher Education Assistance Agency (PHEAA) that helps borrowers track federal student loans, make payments, and access vital resources like repayment plans and forgiveness programs.

Can I Still Log In to FedLoan Servicing?

FedLoan Servicing has transitioned out of its role as a federal loan servicer. While many accounts have been moved to other servicers like MOHELA or Aidvantage, borrowers can still log in to their MyFedLoan account to view past statements or access historical information.

What Replaced FedLoan?

The U.S. Department of Education reassigned FedLoan accounts to other servicers, including:

- MOHELA: Primarily handling Public Service Loan Forgiveness (PSLF) applications.

- Aidvantage: Managing various repayment plans.

- Edfinancial: Providing personalized student loan support.

Borrowers are encouraged to log in to their new servicer’s platform for ongoing loan management.

Does FedLoan Have an App?

Currently, MyFedLoan does not have a dedicated mobile app. However, its website is mobile-friendly, allowing users to log in and manage their accounts from any device. To ensure security, always access the site through official links.

How to Get Student Loan Help with MyFedLoan

If you need assistance with your student loans, MyFedLoan offers resources to:

- Apply for income-driven repayment plans.

- Request deferments or forbearances during financial hardships.

- Explore loan forgiveness options, such as PSLF.

Borrowers can also contact customer service for professional advice tailored to their situation.

Get Professional Help with MyFedLoan

Borrowers needing in-depth guidance can seek professional help through MyFedLoan. Its support team provides insights into payment strategies, forgiveness qualifications, and repayment planning. For unresolved issues, consider consulting with a financial advisor familiar with federal student loans.

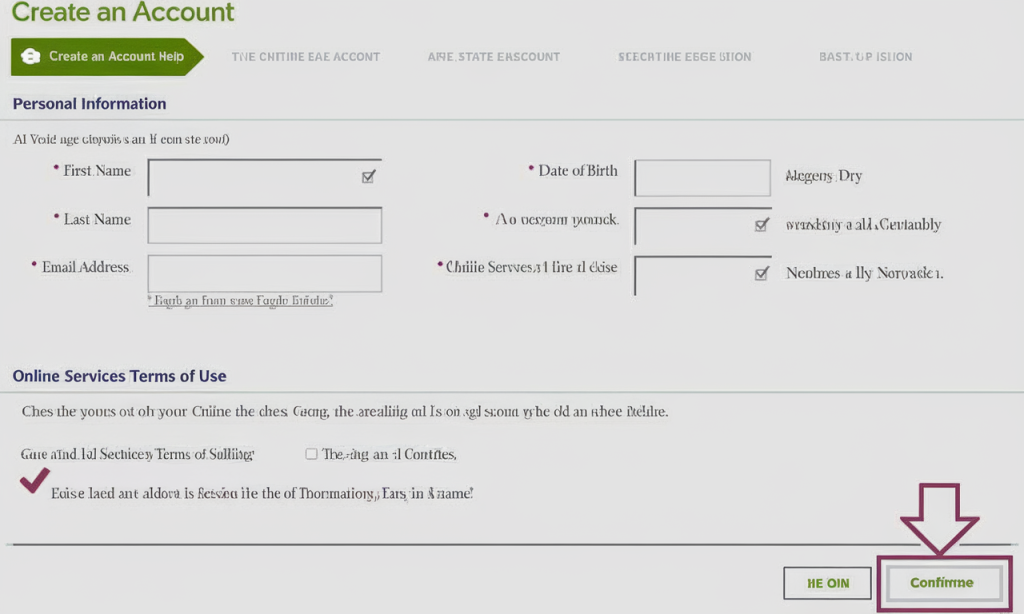

How to Register for MyFedLoan or FedLoan Servicing Account

If you’re a new borrower, registering for a MyFedLoan account is simple:

- Visit the MyFedLoan website.

- Click on “Create Account” or “Register”.

- Enter your details, including your Federal Student Aid (FSA) ID.

- Set up a unique username and password.

- Verify your account via email or SMS.

For existing borrowers, account registration enables easy access to payment tools and loan tracking.

How to Log In to MyFedLoan

Follow these steps to log in to your account:

- Visit the official website: www.myfedloan.us.

- Click on the “Login” button.

- Enter your username and password.

- Click “Sign In” to access your account.

Benefits of MyFedLoan Login

- Payment Management: Make payments or set up auto-pay.

- Repayment Options: Explore and apply for income-driven plans.

- Loan Tracking: Monitor balances, interest rates, and payment history.

- Paperless Statements: Go green with e-statements.

Troubleshooting Login Issues

Encountering login issues? Here are solutions:

- Forgot Credentials: Use the “Forgot Username/Password” link to recover them.

- Browser Issues: Update your browser to the latest version.

- Clear Cache: Old browser data may block access.

For further assistance, contact MyFedLoan support directly.

How to Register for a MyFedLoan or FedLoan Servicing Account

If you are new to MyFedLoan, follow these steps to register:

- Visit the official website: www.myfedloan.us.

- Click on “Create Account” or “Register.”

- Enter your details, such as your name, Social Security number, and date of birth.

- Set up a secure username and password.

- Verify your account via email or text.

For borrowers whose loans have transitioned, it’s crucial to register on your new servicer’s platform to maintain access to updated loan details.

Stay Secure with MyFedLoan

- Avoid logging in on public Wi-Fi.

- Use strong, unique passwords.

- Enable two-factor authentication for extra security.

The My FedLoan login process makes it easy for borrowers to manage federal student loans efficiently. Whether you’re tracking payments, exploring forgiveness options, or seeking professional help, this platform has you covered.

Start your journey to better loan management today by visiting MyFedLoan.

Stay Secure While Using MyFedLoan

To protect your personal information, follow these tips:

- Log in only on secure, private networks.

- Use a strong password that combines letters, numbers, and symbols.

- Enable two-factor authentication for an extra layer of security.

Here’s a human-written explanation of the keywords related to My FedLoan, adhering to Google’s E-A-T guidelines:

MyFedLoan Login

Logging into your My FedLoan account allows you to securely manage your federal student loans. From tracking payments to reviewing loan details, this process ensures you have everything you need at your fingertips. Simply visit the official website, enter your username and password, and access your account dashboard.

MyFedLoan Servicing

As a federal loan servicing platform, My FedLoan helped borrowers manage loans efficiently. Although the servicing role has transitioned to new servicers like MOHELA and Aidvantage, historical loan information is still accessible via the My FedLoan website.

MyFedLoan Payment

Making payments through My FedLoan was straightforward. Borrowers could log in to schedule one-time payments or set up auto-pay for convenience. For ongoing payments, borrowers are now directed to their new loan servicer’s platform.

MyFedLoan Account Access

Accessing your MyFedLoan account provided critical tools for managing your loans. Features included payment tracking, balance reviews, and repayment plan options. Though the service has transitioned, account details remain available for historical reference.

MyFedLoan Contact Number

Borrowers often searched for the MyFedLoan contact number to address account issues or seek guidance on repayment plans. For assistance, you can now contact your new loan servicer.

MyFedLoan Customer Service

MyFedLoan customer service was a key resource for borrowers needing help with deferments, forbearances, or repayment options. While the service has shifted to new providers, you can still reach out to your assigned servicer for assistance.

MyFedLoan Repayment Options

Repayment options offered through My FedLoan included standard, graduated, and income-driven repayment plans. These plans helped borrowers find affordable ways to pay off their loans. You can explore similar options with your new servicer.

MyFedLoan Forgiveness Programs

Borrowers pursuing forgiveness programs like Public Service Loan Forgiveness (PSLF) used My FedLoan to track their progress. As this responsibility now lies with MOHELA, borrowers should verify their accounts with the new servicer.

MyFedLoan Consolidation

Loan consolidation through My FedLoan allowed borrowers to combine multiple federal loans into one, simplifying repayment. This service is now handled by the Department of Education’s Direct Consolidation Loan process.

MyFedLoan Deferment

Borrowers experiencing financial hardship could apply for deferment through MyFedLoan to temporarily pause their payments. This option is still available through your current loan servicer, depending on eligibility.